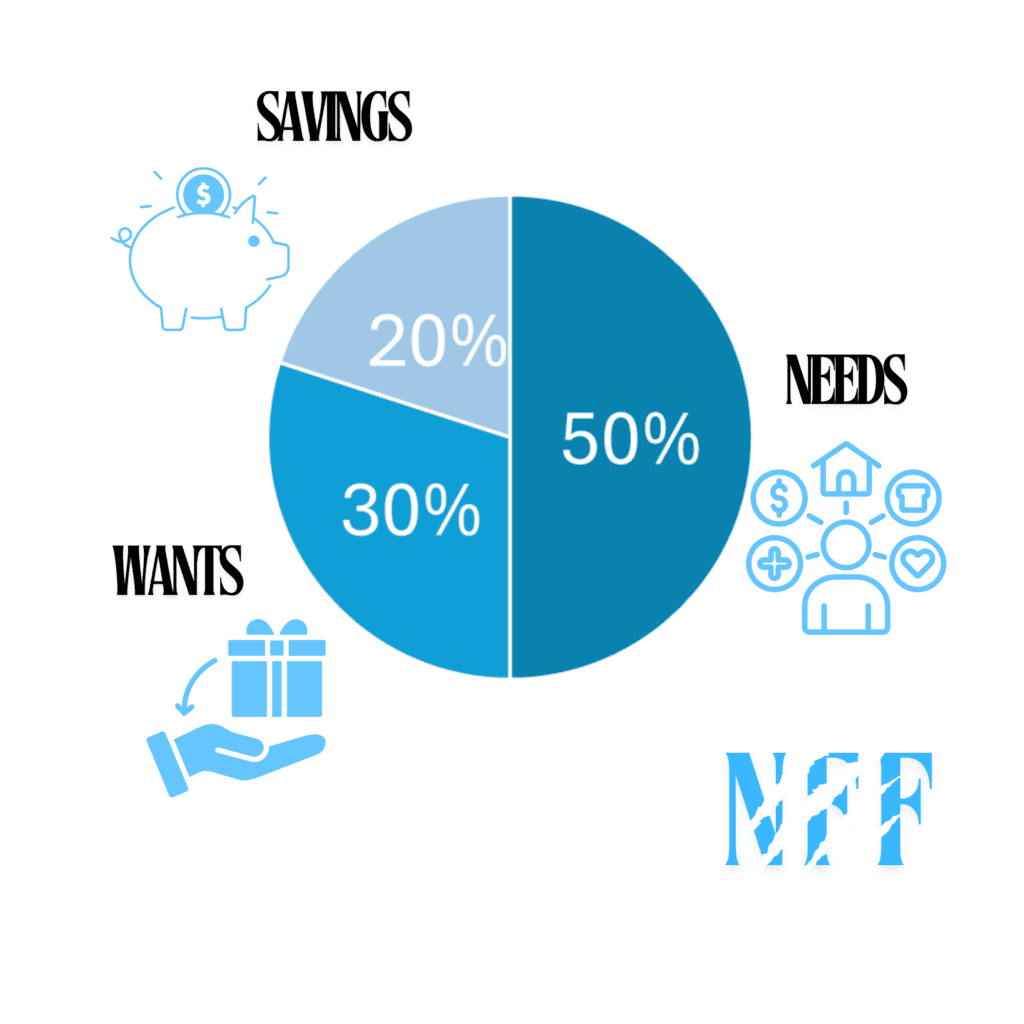

Understanding the 50/30/20 Budget: A Simple Guide to Managing Your Money

The 50/30/20 budget is a simple, straightforward approach to managing your finances. It’s perfect for students or anyone looking to gain control over their spending without feeling overwhelmed by complicated financial strategies. The core idea is to break down your income into three categories—needs, wants, and savings—and allocate a set percentage of your after-tax income to each. Here’s how it works:

1. 50% for Needs

Half of your monthly income should go towards your essential expenses, or “needs.” These are the non-negotiables that you must cover to live and maintain basic financial stability. Common expenses in this category include:

- Rent or housing payments

- Utilities (electricity, water, internet, etc.)

- Groceries

- Transportation costs (gas, public transit)

- Insurance (health, car, etc.)

- Minimum debt payments

The goal is to limit these expenses to no more than 50% of your income. If your “needs” take up more than half of your income, it might be worth reviewing where you can cut back or adjust.

2. 30% for Wants

The next 30% of your income goes to “wants”—the fun and flexible part of your budget. These are things you enjoy but could live without if necessary. Examples include:

- Dining out or takeout

- Entertainment (movies, concerts, subscriptions)

- Shopping for clothes, electronics, or hobbies

- Travel or vacations

- Upgraded phone or tech plans

This category is where most people tend to overspend, so it’s important to be mindful. Keeping your discretionary spending under 30% helps ensure you’re balancing enjoyment with financial responsibility.

3. 20% for Savings and Debt Repayment

The final 20% of your income should go toward building your financial future and security. This includes:

- Emergency fund contributions

- Retirement savings (e.g., Roth IRA)

- Additional debt repayment (beyond minimum payments)

- Investments

Allocating 20% of your income to savings and debt repayment helps ensure you’re not just living for today but also planning for tomorrow. Whether you’re saving for a big purchase, paying off student loans, or starting to invest, this portion of your budget sets you up for financial stability in the future.

Why the 50/30/20 Budget Works

The beauty of the 50/30/20 budget is its simplicity and flexibility. It gives you clear guidelines on how to manage your income without being overly restrictive. It’s also easily adaptable to changes in income or expenses. For students or first-time budgeters, it’s a great way to start understanding where your money is going and how to make sure you’re covering all the essentials while still enjoying life and saving for the future.